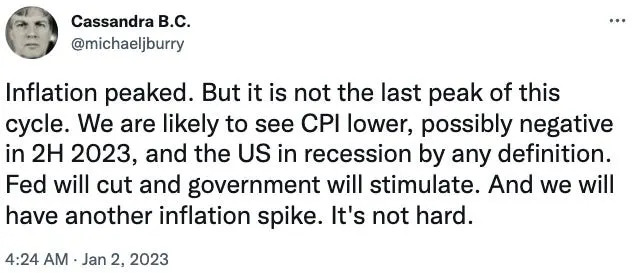

Michael Burry, the hedge fund manager depicted in the movie “The Big Short,” has recently issued a warning that we may not have seen the peak of inflation in this cycle yet. This could potentially be very bad news for the economy, as rising inflation can lead to a variety of negative consequences.

Here is a breakdown of Burry’s thinking on the matter:

-

Inflation has peaked for now: In June, inflation reached its highest level in 40 years at 9.1%, and by November, it remained above 7%, significantly above the 2% target set by the US Federal Reserve. In response, the central bank raised its base interest rate from near-zero to more than 4% and has indicated that it may reach a peak above 5% in 2023. These actions were taken in an effort to address the high levels of inflation and stabilize the economy. It’s important to note that inflation, which is defined as the rate at which the general level of prices for goods and services is rising and subsequently, purchasing power is falling, can fluctuate over time. Currently, it appears that inflation has peaked, at least for the time being.

-

Possibly negative in the second half of 2023: However, Burry predicts that we may see consumer price index (CPI) lower, possibly even negative, in the second half of 2023, which could lead to a recession in the United States. These economic events could have significant impacts on individuals and businesses, and it is important to pay attention to the trends and actions of central banks and governments in response. This means that the general level of prices for goods and services would actually be falling, which could have various consequences.

-

U.S in recession: One potential consequence of negative inflation is a recession. A recession is defined as a significant decline in economic activity lasting more than a few months, which is typically marked by a fall in GDP, an increase in unemployment, and a decline in the stock market. If inflation were to become negative in the U.S., it could potentially trigger a recession.

-

Fed cuts rates: In response to a recession, the Federal Reserve (also known as the “Fed”) would likely cut interest rates in an effort to stimulate the economy. The Fed has a number of tools at its disposal to help stabilize the economy, and one of them is adjusting the federal funds rate, which is the rate at which banks lend money to each other overnight. If the Fed were to cut this rate, it would make borrowing cheaper, potentially encouraging businesses to invest and hire more workers. The purpose of raising interest rates is to reduce the upward pressure on prices by decreasing spending, investing, and hiring. However, this can also have negative consequences, such as reducing corporate profits and slowing economic growth, which can lead to declines in asset prices and potentially even a recession. It’s a delicate balance for central banks to strike in order to maintain stability in the economy.

-

Government will stimulate: In addition to the Fed’s efforts to stimulate the economy, the government may also implement stimulus measures, such as increasing spending on infrastructure or providing financial assistance to individuals and businesses. These measures are intended to help boost economic activity and get the economy back on track.

-

We get another inflation spike: He added: “Fed will cut and government will stimulate. And we will have another inflation spike. It’s not hard.” This means that all of this stimulus could potentially lead to another spike in inflation. This is because increasing spending and making borrowing cheaper can lead to more money circulating in the economy, which can drive up prices.

-

Another central bank tightening cycle to cool inflation: If inflation were to spike again, it would likely lead to another central bank tightening cycle, in which the Fed would increase interest rates in an effort to cool down inflation. This tightening cycle could have negative impacts on asset prices, such as stocks and real estate.

Burry believes that inflation will decrease and the economy will weaken in 2023, which will lead to the Federal Reserve cutting interest rates and the government increasing spending in an attempt to stimulate growth. This increase in demand could then cause inflation to rise again.

In April 2020, Burry warned that the reopening of the economy after the pandemic could result in higher inflation. He also pointed out that American households were putting away less money each month, accumulating debt, and were on track to deplete their savings by December, which could lead to a decline in consumer spending and a prolonged recession.

Burry is well-known for his successful bet against the housing bubble in the mid-2000s, which was depicted in the book and movie “The Big Short.” He also made negative bets against Tesla and Ark Innovation fund in 2021 and was an early investor in GameStop before its stock price skyrocketed at the beginning of that year. Additionally, he warned of the “greatest speculative bubble of all time in all things” last summer and cautioned buyers of meme stocks and cryptocurrencies about the possibility of a “mother of all crashes.”

It’s important to note that this is just one possible scenario, and the future is always uncertain. However, given Burry’s track record of accurately predicting economic events, it is worth paying attention to his warning and considering the potential implications.