Oil prices remain volatile amid demand pessimism and constrained supply

Oil prices remain volatile due to a combination of factors including slowing global growth, concerns about a potential global recession, and constrained supply. Forecasts for oil prices in the future are uncertain, with estimates ranging from $80/bbl in 2024 to $110/bbl in 2022. Factors that could impact supply include EU sanctions on Russia, OPEC+ production capacity, and the outlook for US shale oil. Demand could be affected by a potential global recession and the easing of COVID-19 restrictions in China. OPEC+ production will remain subject to quotas in 2023, with spare production among the group remaining low at around 3.5 mb/d. Predictions from Goldman Sachs and JP Morgan also vary, with uncertainty still prevailing.

During the war in 2022, Poland became the second largest weapons supplier to Ukraine, with the weapons’ total value exceeding $1.6 billion.

The war between Ukraine and Russia has had a significant impact on relations between the two countries. Poland has supported Ukrainian sovereignty and backed NATO-Ukraine cooperation, as well as Ukraine’s efforts to join the European Union. In response to the Russian military buildup near Ukraine, Poland has supplied Ukraine with weapons, ammunition, and humanitarian aid. The value of these weapons has exceeded $1.6 billion as of May 2022. This support has led to an improvement in relations between Poland and Ukraine. It is important for traders to monitor the situation between Ukraine and Russia and consider the potential impact on global markets and geopolitical tensions.

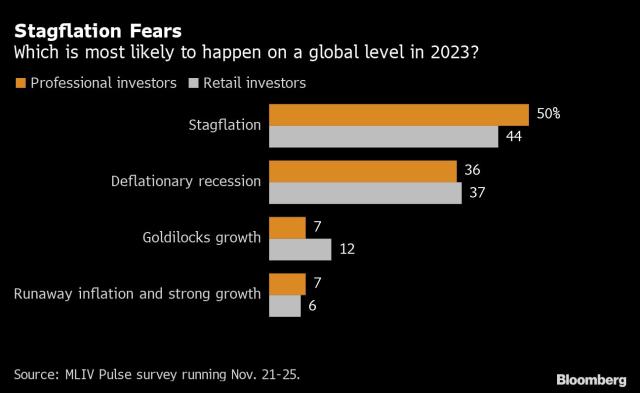

Stagflation Will Rule 2023, Keeping Stocks in Peril

Stagflation, defined as a combination of slow economic growth and high inflation, is expected to be the key risk for the global economy in 2023, according to a survey of 388 investors. Almost half of respondents said this scenario is the most likely outcome for next year, with deflationary recession being the second most likely and economic recovery with high inflation being the least probable. The results of the survey signal another difficult year for risk assets, with over 60% of participants saying that investors around the world are still too bullish on asset prices. The strength of the US dollar is also expected to weaken further in the coming month, which could create opportunities in what is expected to be a lackluster 2023. The S&P 500 is expected to finish the year within a range of 10% higher or lower.

Eurozone heading into recession at the end of this year

The European Union (EU) and most EU countries will experience an economic recession in the last quarter of 2022, according to the European Commission’s autumn economic forecast. Inflation is expected to average 9.3% in the EU and 8.5% in the eurozone for 2022, before decreasing to 7% in the EU and 6.1% in the eurozone in 2023. However, GDP growth is expected to be around 3.3% in the European Union in 2022, before slowing to around 0.3% in the EU and eurozone in 2023. Unemployment rates in the EU are predicted to be 6.2% in 2022, 6.5% in 2023, and 6.4% in 2024. The European Central Bank (ECB) has raised interest rates three times this year in an effort to tackle rising prices and may continue to do so, potentially making mortgages and credit cards more expensive for consumers. Inflation in the eurozone reached a record high of 10.7% in October 2021, driven by higher energy prices and food, alcohol, and tobacco costs. There have been various strike movements in EU countries demanding higher wages due to record inflation.