Unlocking Financial Freedom: Insights from Robert Kiyosaki’s Cash Flow Quadrant

In the pursuit of financial independence, many of us find ourselves trapped in a never-ending cycle of work, taxes, and limited financial growth. But what if there was a way to break free from this cycle and step into a world where you work less, earn more, and pay fewer taxes? Robert Kiyosaki’s book, “Cash Flow Quadrant,” promises to provide the key to unlock this elusive financial freedom.

Understanding the Cash Flow Quadrant

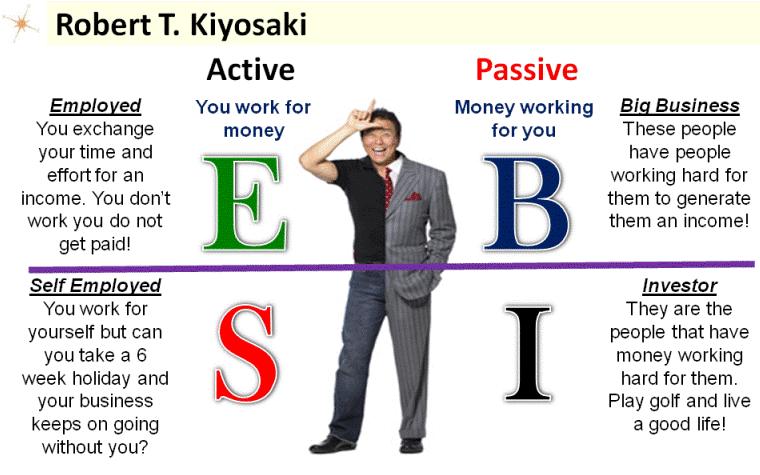

Robert Kiyosaki’s “Cash Flow Quadrant” is more than just a book; it’s a blueprint for reshaping your financial future. It delves into the four quadrants of earning income: Employee (E), Self-Employed (S), Business Owner (B), and Investor (I). By identifying which quadrant you primarily operate in, Kiyosaki helps you comprehend why some people amass wealth effortlessly while others struggle paycheck to paycheck.

The “E” and “S” quadrants represent the left side of the quadrant, where individuals typically exchange time for money. On the other hand, the “B” and “I” quadrants on the right side of the quadrant symbolize financial freedom, where money works for you.

The Quest for Financial Education

One of Kiyosaki’s core arguments is that the lack of financial education in traditional schooling leaves many ill-prepared to navigate the complex world of money. While we spend years in school, we are seldom taught the fundamental principles of managing and growing our finances. This knowledge gap often leads to a lifetime of toiling for money, instead of making money work for us.

Kiyosaki’s mentor, often referred to as “rich dad,” imparted a crucial lesson: to break free from the financial struggle, we must first educate ourselves about money and the paths to wealth creation.

“Your Guide to Starting a Small Enterprise”

The Department of Trade and Industry (DTI) has recognized the importance of financial education and entrepreneurship in the Philippines. As a result, they have introduced “Your Guide to Starting a Small Enterprise” through the SME Roving Academy, “Ganbay-Negosyo sa Pag-Asenso.”

This comprehensive guidebook offers a step-by-step journey from ideation to establishing a small business. What sets it apart is its interactivity – readers are encouraged to create a business blueprint as they progress through each chapter. It’s not just about theory; it’s about taking action and laying a solid foundation for your entrepreneurial venture.

A Nationwide Initiative

Aligning with the Philippine Government’s goal of generating a million jobs annually, the Department of Trade and Industry, specifically through the Bureau of Small and Medium Enterprise Development (BSMED), has embarked on an ambitious campaign to foster entrepreneurship. Their focus extends beyond instilling an entrepreneurial mindset; they are committed to ensuring that these new enterprises have a robust foundation for growth and success.

Gratitude and Access

In closing, we extend our gratitude to the University of the Philippines Institute for Small-Scale Industries and the Bangko Sentral ng Pilipinas for their invaluable contributions to “Your Guide to Starting a Small Enterprise.” Their support has made this essential resource available to everyone, free of charge, empowering individuals to embark on their journey toward entrepreneurship.

If you’re eager to explore this guide and take your first steps toward financial independence, please reach out to us via private message on our RICHDADph FACEBOOK page. We look forward to your comments, suggestions, and inquiries.